Illustration on the Absurdity of the Media

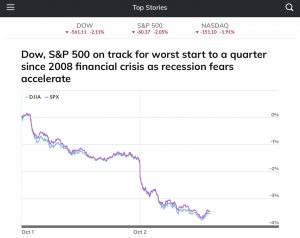

Sometimes I am surprised that the financial media still surprises me with the stuff they come up with. Check out the graphic below.

Of all the things they could have printed, they chose to show a chart of 1 1/2 days into this quarter. They chose to highlight that these 1 1/2 days were similar to a quarter during the financial crisis. They chose to also include the word recession. They hit the trifecta! Folks, the media is our #1 enemy because reporting like this. If we aren’t explicitly and consistently conscious of the media misinformation, then we are implicitly complicit with their messaging.

What headline could they have posted? Well, they could have used a different time horizon, but that wouldn’t fit their story. They could have printed the following headline, “Despite media’s constant talk of recession, a slowing economy and trade wars the market is still up over 16% YTD.” They could have also gone on to give 3, 5, and 10-year returns. Heck, they could have given 20-year returns. However, none of these examples fit the media’s narrative. We need to be constantly reminded of this to avoid the hysteria and unnecessary anxiety that arises from erroneous market reporting.

The S&P 500 is a widely recognized unmanaged index of common stocks generally representative of the US stock market. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy.

By Marcus E. Ortega, ChFC, RFC | Investment Advisor Representative | CEO of Mosaic Financial Associates & Orthopaedist Advisory Group | Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.

©2019 The Behavioral Finance Network. Used with permission.