The Risks of Market Timing

If you’re like most investors, you began your investment program with the intent of achieving any number of goals, some long-term, others shorter-term—such as enjoying a comfortable retirement, sending your children to college, buying a second home or supporting your current lifestyle.

You have invested in stocks and bonds to steadily build and preserve wealth over the decades. Your long-term strategy did not include trying to jump in and out of the market based on its short-term performance. Besides, brief, explosive spurts of volatility, both positive and negative, are typically the norm. In the short run, severe moves in security prices should be expected. But an impulsive investor who abandoned the market during one or more of its sharp downturns may have missed the strong, ensuing rebounds.

Nobody ever got on a roller coaster expecting a level ride.

It’s the same with investing. Over long periods of time, the financial markets can be remarkably steady—since 1926, stocks have never lost money in any 15-year period1—but in the short run, sharp spikes in security prices can be the norm. It is important to be aware of the risks of market timing.

As uncertainty surrounding the eventual economic impact of the coronavirus has recently escalated, the S&P 500 Index has displayed significant volatility—rising or falling at least 3% uncommonly often.2 This volatility suggests that the market can’t seem to make up its mind, triggering a bumpy ride for investors—some of whom may be tempted to pull out of stocks and wait for the market to regain its footing.

But is moving assets from your current portfolio to what you think are more stable, “safer” investments really a good idea? Amid such uncertainty, what can you do to keep your cool and avoid making potentially costly, emotionally- driven decisions?

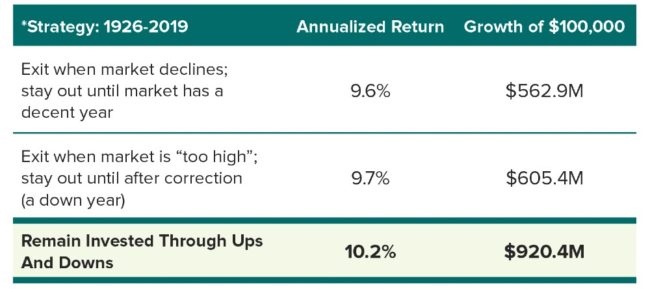

Exhibit 1: Market-Timing Approaches Fall Short

Past performance does not guarantee future results. An investor cannot invest directly in an index or average and they do not include sales charges or operating expenses associated with an investment in a mutual fund, which would reduce total returns. Source: Federal Reserve and Standard & Poor

Understand the Risk of Market Timing

When it comes to investing, what’s the biggest risk of all? Market risk? Company risk? Interest-rate risk? Credit risk? Inflation risk?

No, for many investors, the biggest risk is, quite fundamentally, the risk of losing money.

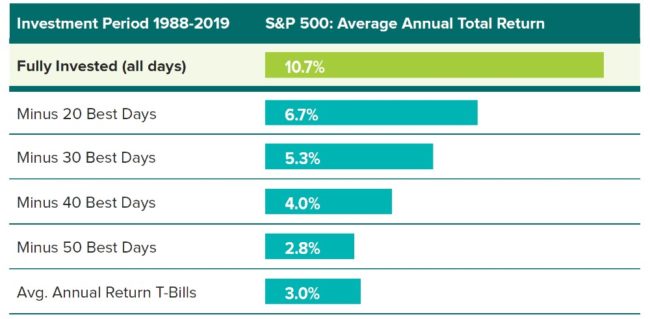

And because losing money can provoke a powerful, visceral reaction, some investors turn to market timing: buying or selling security-based on future price predictions (Exhibit 2).

Exhibit 2: Dangers of Market Timing

Past performance does not guarantee future results. An investor cannot invest directly in an index or average and they do not include sales charges or operating expenses associated with an investment in a mutual fund, which would reduce total returns. Source: Federal Reserve and Standard & Poor.

But choosing when to invest, or “time” the market is difficult. Investors who attempt to time the market may run the risk of missing periods of exceptional returns.

Clearly, market timing can seriously diminish long-term performance if market volatility isn’t managed properly. On the other hand, volatility provides investors with the opportunity to buy stocks and stock mutual funds at attractive prices (Exhibit 3).

Exhibit 3: Strategic Market Timing Is Harmful to Your Wealth

Past performance does not guarantee future results. An investor cannot invest directly in an index or average and they do not include sales charges or operating expenses associated with an investment in a mutual fund, which would reduce total returns. Source: Federal Reserve and Standard & Poor. Index returns are for illustrative purposes only and do not represent actual portfolio performance. Index returns do not reflect any management fees, transaction costs or expenses. One cannot invest directly in an index. Bonds will decrease in value as interest rates rise. Past performance does not guarantee future results. The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The S&P is a float-weighted index, meaning company market capitalizations are adjusted by the number of shares available for public trading. Information provided by SEI Investments Management Corporation (SIMC), a wholly-owned subsidiary of SEI Investments Company (SEI). Investing involves risk, including possible loss of principal. Diversification may not protect against market risk. This material is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice and is for educational purposes only. There can be no assurance your goals will be met. Your advisor is not affiliated with SEI or any of its subsidiaries but may work with SEI to provide some of the services listed in this piece.

As financial advisors, we are committed to:

- Making a point of knowing you and knowing your individual financial goals.

- Helping you avoid making emotion-driven mistakes in turbulent times.

- Always being available to consult with you, in good markets and rough markets.

Together we will create your personalized goals-based investment plan—with an emphasis on managing risk, and designed to produce relatively consistent and predictable results in various market environments.

Important Information:

Index returns are for illustrative purposes only and do not represent actual portfolio performance. Index returns do not reflect any management fees, transaction costs or expenses.

One cannot invest directly in an index. Bonds will decrease in value as interest rates rise. Past performance does not guarantee future results.

The S&P 500 Index, or the Standard & Poor 500 Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The S&P is a float-weighted index, meaning company market capitalizations are adjusted by the number of shares available for public trading. Information provided by SEI Investments Management Corporation (SIMC), a wholly owned subsidiary of SEI Investments Company (SEI). Investing involves risk, including possible loss of principal. Diversification may not protect against market risk. This material is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice and is for educational purposes only. There can be no assurance your goals will be met. Your advisor is not affiliated with SEI or any of its subsidiaries, but may work with SEI to provide some of the services listed in this piece.

This is an article published by SEI in the Knowledge Center.

If you’re considering working with us here at Mosaic, we invite you to learn more about who we serve and how we help them. You can also contact us with any questions you have.

Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.