Slowing Growth, Speeding Outbreak: Time to Panic?

The global economy has been plagued by “animal dispirits”1 since late 2018, as noted in our third-quarter 2019 Economic Outlook. Important economic indicators have been pointing to slowing growth — or worse, possible recession — in many parts of the world. On top of this, a newly identified coronavirus outbreak that began in China is threatening to undermine or potentially derail economic activity there and beyond.

Do we think it’s time to panic? As usual, our short answer to this is no. But it’s certainly an understandable question considering the global economic slowdown and budding viral pandemic, so let’s see if we can come up with a more comprehensive answer.

- Important economic indicators have been pointing to slower growth — or worse, possible recession — in many parts of the world.

- It is notoriously difficult — if not impossible — to time an investment strategy to turning points in business cycles or bull and bear markets.

- We think investors would be better served to remember that economic slowdowns and positive equity market returns have historically gone hand in hand.

A Synchronized Global Slowdown

From the fourth quarter of 2018 through most of 2019, a variety of political and economic developments dogged global economic activity. The U.S. threatened at various times to meaningfully ratchet up its tariffs on goods from China, Europe and Mexico. China showed clear signs of slowing economic growth, with negative implications for the broader global economy — especially the country’s main emerging- and developed-market trading partners. In the U.K., intensifying Brexit drama raised the risk of having a sudden and disorderly withdrawal from the EU. Compounding the negative impacts of these headline-grabbing issues, we also saw a globally synchronized slowdown, especially as manufacturing contracted in many countries during 2019.

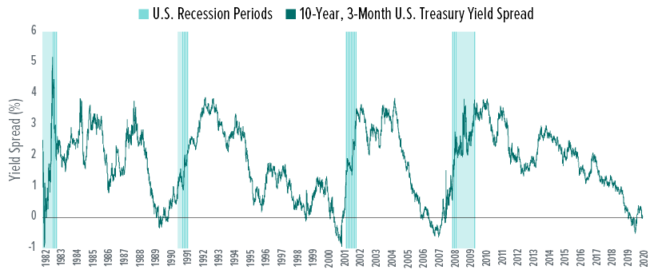

Despite these worries, after sharply selling off at the end of 2018, riskier assets like equities and high-yield bonds rebounded in 2019 and held up well throughout the year. However, the U.S. Treasury market reflected persistent pessimism for much of 2019 as yields on longer-dated bonds fell below short-term rates (specifically, the yield on 10-year Treasury notes fell below the yield on 3-month Treasury bills). This dynamic, referred to as yield-curve inversion, has historically been a reliable indicator of slower growth and rising recession risk. As a result, market observers began to assert that we might see a recession in 2020.

Is it Different This Time?

There’s a widespread belief that one of the most dangerous assumptions an investor can make is that “things are different this time.” This is considered a risky way of thinking because even though market history may not repeat precisely, it often rhymes — and investors mistake these historical similarities as a prompt to react defensively to potential economic slowdowns and market selloffs. Of course, this view relies heavily on hindsight bias, which is the misguided belief that a negative event (such as a financial crisis, recession or bear market) could have been predicted accurately in advance and therefore avoided.

We are skeptical that any investor can successfully and consistently time portfolio exposures around economic cycles or market turning points. Nevertheless, we pay close attention to market conditions that may present opportunities to marginally enhance returns or manage risk. In our view, there are several important factors in the current environment that are worthy of note:

Modestly favorable political developments. At the end of 2019, negotiations between China and the U.S. finally produced a “phase one” trade agreement that called for lowering certain tariff rates in February 2020 and canceling (or at least delaying) the implementation of others. U.K. election results in December provided a clearer Brexit path, and signaled that the process will likely follow a deliberate pace until at least the end of 2020.

Signs of the global manufacturing slowdown bottoming out. As 2019 came to a close, it appeared that the worst of the manufacturing slowdown may be behind us (even though the upturn has been muted so far and countries like Germany and the U.K. are still struggling). Importantly, the services sector in most countries has avoided the sharp slowdowns of more cyclical areas like manufacturing.

Global economic and market risks posed by the coronavirus outbreak. This is especially difficult to assess given the biological, social and political complexities involved, particularly considering the limited historical precedents for potential epidemics and pandemics. As of February 18, the number of recoveries is outpacing the number of fatalities; however, it has spread rapidly, and the outbreak may still be in its early stages. The outbreak—both the disease itself and the measures taken to contain its spread—will likely have significant negative impacts on economic activity, especially in China, but we don’t know how permanent the resulting losses will be.

Developments regarding the yield curve. The spread between 10-year and 3-month Treasury yields, which many economists view as a reliable leading indicator of U.S. recessions2, returned to positive territory in late 2019 after turning negative in the first half of the year (Exhibit 1). The initial inversion of this spread was relatively short-lived, as the Federal Reserve (Fed) quickly reversed course and began loosening monetary policy in response to softening economic conditions. We are careful not to take too much comfort in this development as Exhibit 1 also shows it’s not unusual for a yield-curve inversion to reverse months before a recession commences. Furthermore, the spread teetered between positive and negative in late January and February 2020 as concerns about global growth prospects returned in response to the coronavirus outbreak.

EXHIBIT 1: 10-Year, Three-Month Yield Spread

Daily data from January 4, 1982 thru February 12, 2020. Source: Federal Reserve Bank of St. Louis

So, Should Investors Panic?

We maintain our initial answer: not in our opinion. Making wholesale changes to a diversified strategic portfolio that’s well-suited to an investor’s circumstances is rarely (if ever) a good idea. And, as we argue in other commentaries (hopefully persuasively), it is notoriously difficult — if not impossible — to time an investment strategy to turning points in business cycles or bull and bear markets; attempts to do so can have steep costs in terms of foregone returns.3

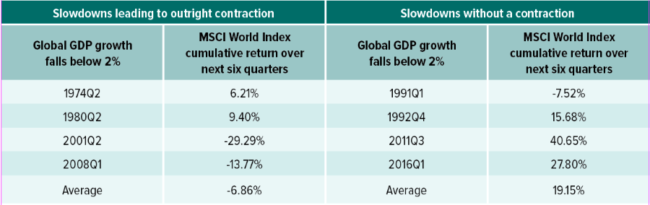

The tables in Exhibit 2 show eight examples of how global equities performed after global economic growth fell below an annualized 2% rate, specifically the following six-quarter period (the average amount of time it historically takes to return to growth of 2% or better). Contraction (defined as one or more quarters of negative GDP growth) followed only half of the slowdowns. An even fewer number of slowdowns — three of eight — saw negative global equity returns over the full ensuing six-quarter period. The average return for all subsequent six-quarter periods was over 6%, and the median return was just under 8%.

EXHIBIT 2: Global Equity Performance Following Economic Slowdowns

Index performance quoted in price return. Quarterly data from second-quarter 1970 through second-quarter 2019. Sources: Organisation for Economic Co-operation and Development (OECD), Bloomberg, SEI

It’s always a good idea to periodically reassess whether a strategic portfolio is still compatible with an investor’s objectives and risk-taking capacity.

So is there anything an investor can do? Sure. It’s always a good idea to periodically reassess whether a strategic portfolio is still compatible with an investor’s objectives and risk-taking capacity. Then, based on this reassessment, if a current strategic portfolio is still appropriate and if desired, prudent active asset-allocation tilts may be used in an effort to either enhance returns or mitigate risk. Active investment managers can also pull a variety of levers in an effort to manage risk or enhance returns.

Where We Currently Stand

Some key political risks to the global economy have been tempered in recent months, and global manufacturing activity appears to be in the early stages of a rebound. Both monetary and fiscal policies should remain supportive globally. And while the global economy has experienced a significant slow patch that included manufacturing recessions in multiple countries, other factors like credit conditions and labor markets have not pointed to a high probability of a recession in the near term. As a result, it’s probably not time to panic (it almost never is). We think investors would be better served to remember that economic slowdowns and positive equity market returns have historically gone hand in hand.

1 The concept of “animal spirits” was articulated by John Maynard Keynes in his 1936 book, The General Theory of Employment, Interest and Money, as the aggregate willingness of businesses to take the risk of investing in expansions and new projects — activities that tend to enhance productivity, support economic growth and improve living standards.

2 See, for example, https://www.newyorkfed.org/medialibrary/media/research/capital_markets/Prob_Rec.pdf. Accessed on February 18, 2020.

3 See “Attempting to avoid a recession: Fortune or folly?” (July 2019).Information provided by SEI Investments Management Corporation. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice and is intended for educational purposes only. Investing involves risk, including possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Diversification may not protect against market risk. Index returns are for illustrative purposes only and do not represent actual portfolio performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

This is an article originally published by SEI in February 2020 in the Knowledge Center.

If you’re considering working with us here at Mosaic, we invite you to learn more about who we serve and how we help them. You can also contact us with any questions you have.

Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.