The Lunacy of Media Behavior

Dear Client/Prospect,

Every now and then we are amazed at the lunacy of the financial media.

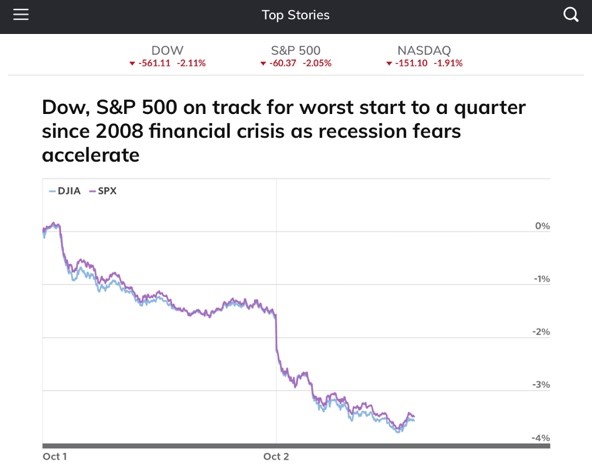

Early in October, the media printed headlines telling us that we were off to the worst start to the quarter since the financial crisis as recession fears accelerate (see graphic below). Some of them reminded us that Black Monday happened in October or that last year October was a negative month.

The market ended up being positive in October, but even if it had been negative, it would have been a grave mistake to make investment decisions based on headlines and fear-mongering.

Allowing the media to influence financial decisions is one of the gravest errors an investor can make.

The financial media exists to get your eyeballs (so they can sell ads and make money). The media could care less about your values, feelings or aspirations. In fact, they will often employ fear (which influences investors to make poor decisions) for their own pocketbooks.

I know how alluring these emotional headlines can be. The media is a master at getting our attention/eyeballs. My job is to help you overcome emotional impulses and make thoughtful decisions that in line with your plan.

This is just another example (among many) of why we need to ignore the media.

By Marcus E. Ortega, ChFC, RFC | Investment Advisor Representative | CEO of Mosaic Financial Associates & Orthopaedist Advisory Group | Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.

©2019 The Behavioral Finance Network. Used with Permission.